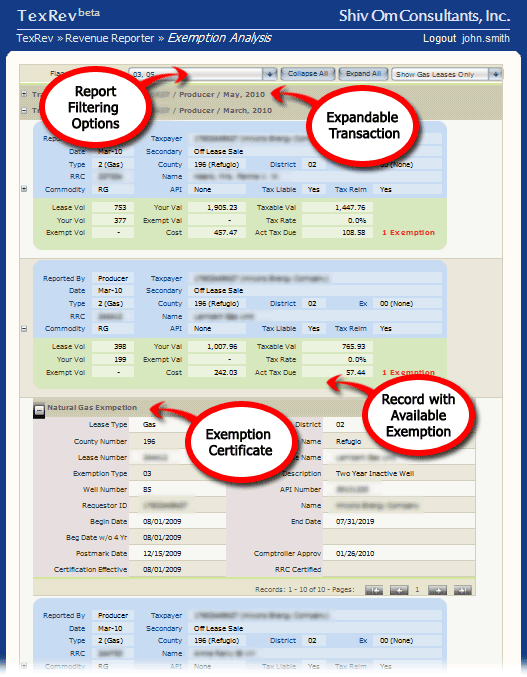

The Exemption Lookup function can be used to analyze your target transaction(s) and return available exemptions for your taxable filings. The system will check each record with tax due of your selected transactions and compare it to the exemptions registered with the Comptroller's office. TexRev will return any records found in a filterable report, grouped by transaction, by record, by exemption. Click on the plus icons to expand a given section; click on the minus icon to collapse it.

Report Filtering Options and Navigation

Depending on the amount of records you are running the process on, the possible exemption report can exceed hundreds of records. You can filter the report down to a more manageable size by using the Report Filtering Toolbar at the top of the report.

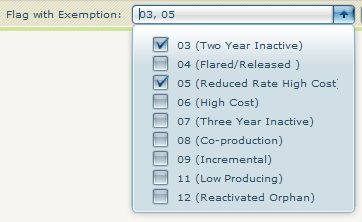

Filtering By Exemption Type

By default, all exemption types are shown, but you can select exactly which exemptions you'd like to see by Clicking the Flag With Exemption drop down list.

Simply check or uncheck the exemptions you would like to filter by, then click outside of the list. The Report will automatically show the selected exemptions only.

Collapsing and Expanding by Transactions

If you have been navigating multiple transactions within your report, it can be useful to expand or collapse all transactions instantly. Use the Collapse All and Expand All buttons to do so.

![]()

Note: These buttons do not affect the collapsed exemptions.

Record With Available Exemption

TexRev lists the target records in the blue and green sections. Each record is presented two sections: Blue for text fields and green for numerical fields.

Text Field Values

The blue section of each record shows the key fields and and non-numerical values that would be submitted in the EDI file.

Note: TexRev fills in the Taxpayers' Names and Lease Name values using the State's Taxpayer and Lease Master files. Those fields do not get uploaded from your import.

Numerical Field Values

The green section of each record shows the updatable numerical fields of each record. The values shown are what you uploaded to TexRev, not what TexRev predicts the final values of the target record would be after the amendment is processed.

Exemption Certificate

TexRev nests the available exemptions under each target record. If the exemptions are collapsed, click on the plus icon to the left of a given target record to see its possible exemption(s). The report will show Exemption Certificates in the red sections.

Note: While exemptions shown for gas leases are generally accurate, the following exemption types require additional review

•All Oil Lease Exemptions - The State does not require taxpayers to report API information on taxable production, so there is no way for TexRev to predict how much production should be reported under an exempt API.

•Type 11 (Low Producing Wells) - TexRev does not currently support detailed analysis of Type 11 exemptions. The report will show them when they exist, however, there are currently no ties between the State's low production tables and the production reported in the target record.