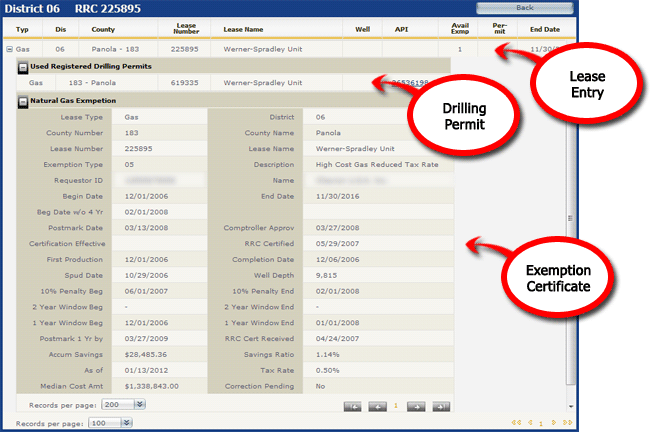

The Lease Info Page displays all available information registered with the Texas Comptroller about a given District/Lease ID pair.

TexRev displays the information in a report consisting of Lease Entries of all county, lease and API combinations registered on the Comptroller's Lease Master. You can drill down any line item to view two subreports: Used Registered Drilling Permits and Natural Gas Exemptions.

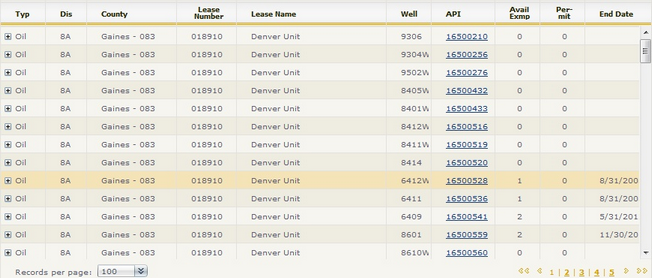

The top level of the Lease Info Report lists each County and API set found for the Lease Number within the District.

Each entry consists of the following fields:

•Typ - Oil or Gas

•Dis - District

•County - Name and Number

•Lease Number - 6 digit number

•Lease Name - Name from the RRC

•Well - given with oil leases

•API - if found

•AvailExmp - Number of registered exemption certificates with the Comptroller

•Permit - Number of permits found with the Comptroller

•End date - Set's end of production according to the Comptroller

If the Lease Entry contains an API number, you can click on it to open the API's OPERATOR/WELLBORE page on the Texas Railroad Commission's website. You can use this page to validate information found from the Comptroller's side and see the well's completion and plugging history.

If either the AvailExmp or Permit fields shows a count of more than zero, then you can click the Plus Icon ![]() in the Typ column to view the found exemption certificates and drilling permits

in the Typ column to view the found exemption certificates and drilling permits

The Drilling Permit Subreport shows any permit numbers used that are assigned to the given lease.

Each entry consists of the following fields:

•Typ - Oil or Gas

•County - Name and Number

•Permit Number - 6 digit number

•Permit's Lease Name- Name from RRC

•Well - Well to which permit is assigned

•API - if found

If the permit contains an API number, you can click on it to open the API's OPERATOR/WELLBORE page on the Texas Railroad Commission's website. You can use this page to validate information found from the Comptroller's side and see the well's completion and plugging history.

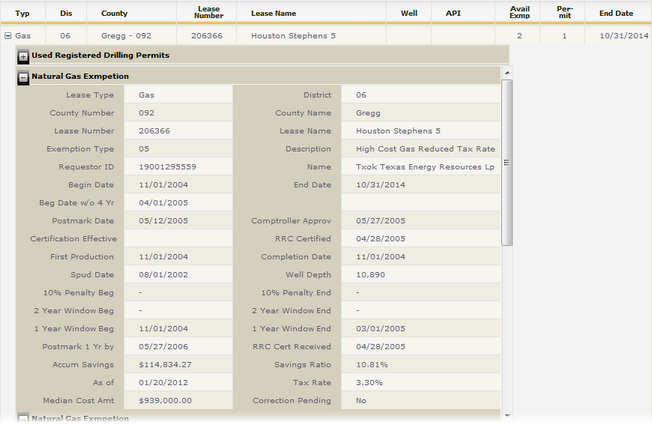

The Natural Gas Exemptions Subreport shows any exemptions certified with the Comptroller's Office for a given lease.

The report displays each exemption in a collapsible two column format. One particular field Shiv Om provides is 'Beg date w/o 4 Yr.' With a quick glance at this field you can instantly see the earliest date the exemption is available. TexRev accounts for the one and two year windows for you. Read on to learn about the rest of the fields.

Each certificate provides some or all of the following information

Field |

Description |

Displayed |

Src* |

|---|---|---|---|

Lease Type |

Oil or Gas |

Always |

T |

District |

District of County |

Always |

T |

Lease Number |

RRC ID |

Always |

T |

Lease Name |

Description from Comptroller |

Always |

T |

Exemption Type |

two digit code identifying exemption |

Always |

T |

Description |

Explains the Exemption Type Code |

Always |

T |

Well Number |

Well ID |

If Available |

T |

API |

API Number |

If Available |

T |

Requester ID |

Taxpayer ID which filed the exemption |

Always |

T |

Name |

Name of Requester |

Always |

T |

Begin Date |

Filing period that the exemption becomes valid |

Always |

T |

End Date |

Last Filing period before the exemption expires |

Always |

T |

Beg Date w/o 4 Yr |

Shiv Om's automatically calculated true beginning production date of when the exemption is available. This calculation ignores the 4 year statue in case your periods are being held open by an extraneous factor such as audit. |

Always |

S |

Postmark Date |

Exemption Postmark Date |

Always |

T |

Comptroller Approv |

Comptroller approval date for exemption |

Always |

T |

Certification Effective |

RRC certification Date of Approval |

If Available |

T |

RRC Certified |

The date RRC certified the lease as eligible for a high cost gas exemption |

If Available |

T |

First Production |

First day of the month following the month the lease produced for the first time |

If Available |

T |

Completion Date |

The year-month the lease was completed according to RRC records |

If Available |

T |

Spud Date |

Can be blank, the year-month drilling started on a new lease, or re-completion of an existing lease |

If Available |

T |

Well Depth |

Depth of well in feet |

If Available |

T |

10% Penalty Beg |

Calculated beginning date of the 10% penalty window on a high cost exemption, if applicable |

Type 5 Only |

S |

10% Penalty End |

Calculated ending date of the 10% penalty window on a high cost exemption, if applicable |

Type 5 Only |

S |

2 Year Window Beg |

Calculated beginning date of 2 Year window, if applicable |

Type 5 Only |

S |

2 Year Window End |

Calculated Ending date of 2 Year window, if applicable |

Type 5 Only |

S |

1 Year Window Beg |

Calculated beginning date of 1 Year window, if applicable |

Type 5 Only |

S |

1 Year Window End |

Calculated beginning date of 1 Year window, if applicable |

Type 5 Only |

S |

Postmark 1 Yr by |

Last date before the expiration of the opportunity to take an exemption on records within the one year window |

Type 5 Only |

S |

RRC Cert Received |

The date RRC certified the lease as eligible for a high cost gas exemption |

Type 5 Only |

T |

Accum Savings |

The actual accumulated savings for the lease, based on any value reported on the lease to the State's office from the beginning date of exemption to the current reporting period. |

Type 5 Only |

T |

Savings Ratio |

The "accumulated savings" as compared to 50% of the "total drilling and completion costs" for the lease. |

Type 5 Only |

T |

As of |

Because the "accumulated savings" and "accumulated savings %" can change anytime a report is filed for the lease, there has to be a date of last calculation that the savings are based on. This would be the "as of" date. The savings you see are based on the values reported on the lease up to the "as of" date. |

Type 5 Only |

T |

Tax Rate |

Calculated by Comptroller’s Office |

Type 5 Only |

T |

Median Cost Amt |

The statistical median of drilling and completion costs reported on applications with a postmark date during the previous fiscal year. |

Type 5 Only |

T |

Correction Pending |

Exemption Correction Pending Code |

Type 5 Only |

T |

** T - Supplied by State of Texas

S - Calculated by Shiv Om