| Show/Hide Hidden Text |

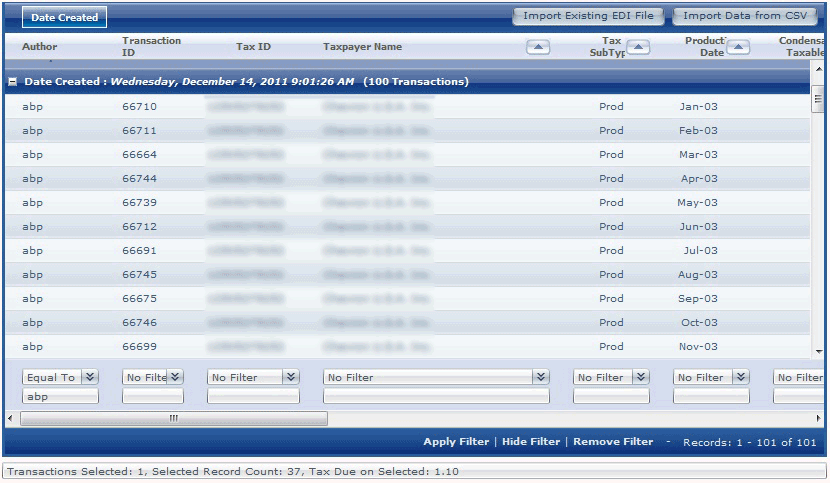

The Transaction Grid is the control within the Revenue Reporter Page that lets you view the current transactions on TexRev that are available to the user.

The Transaction Grid works much like other grids in TexRev, with features such as grouping, sorting, filtering and selecting. See the Grids Section in the Appendix for a detailed explanation of how Texrev's Grids work. Features unique to the Transaction Grid are described below.

Each record in the transaction Grids represents information about an entire transaction. There are fifteen fields available for each record:•Author - The login name of the user who uploaded the transaction •Transaction ID - The unique ID of the transaction assigned by TexRev. The ID is unique even for transactions archived. •Tax ID - The reporting taxpayer's ID number •Taxpayer Name - The reporting taxpayer's name •Tax Sub Type - Whether the transaction is producer reported or purchaser reported •Production Date - The production month and year on which the transaction is reporting •Condensate Net Taxable Value - The total net taxable value impact of the transaction on condensate •Tax Due On Condensate - The tax impact of the transaction on condensate •Nat Gas Net Taxable Value - The total net taxable value impact of the transaction on nonexempt natural gas •Tax Due on Natural Gas - The tax impact of the transaction on nonexempt natural gas •Regulatory Fee Volume - The estimated impact of the transaction on volume eligible for regulatory fee •Regulatory Fee Due - The estimated impact of the transaction on regulatory fee due •Tax Due on High Cost Gas - The tax impact of the transaction on high cost gas •Total Due on Fee and Taxes - The total tax and fee impact of the transaction •Records in Transaction - The number of adjustment records in the transaction |

The records in the Transaction Grid are initially grouped by the Date Created value, but you can remove that grouping and group by any combination of fields. The group footer contains a summary total for each number field of the transactions contained. You can group by as many fields as you like, but the summary total will only be calculated for the last grouping.

Note: Any Grouped By fields do not show up in the column header list. For instance, by default there is no field for Date Created shown on a transaction by transaction basis unless you remove Date Created from the Group By list.

In the example below, the company has multiple Taxpayer IDs. The user adds the Tax ID field to the grouping; and the Tax ID column disappears from the column header.

|

By default, the Transaction records are sorted by Date Created, Taxpayer Name, Tax Sub Type and then Production Date. You can resort the records any way you like. |

By default, the Transaction Grid is filtered to show transactions imported by you. However, if you remove or edit the filter, you may see any active transactions uploaded by your company. |

The Selection Summary Textbox is located directly below the Transaction Grid.

The Revenue Reporter uses it to display statistics about the records currently selected, regardless of group makeup. It shows the number of transactions, the total records contained, and the total tax due if those transactions are submitted to the State. |