| Show/Hide Hidden Text |

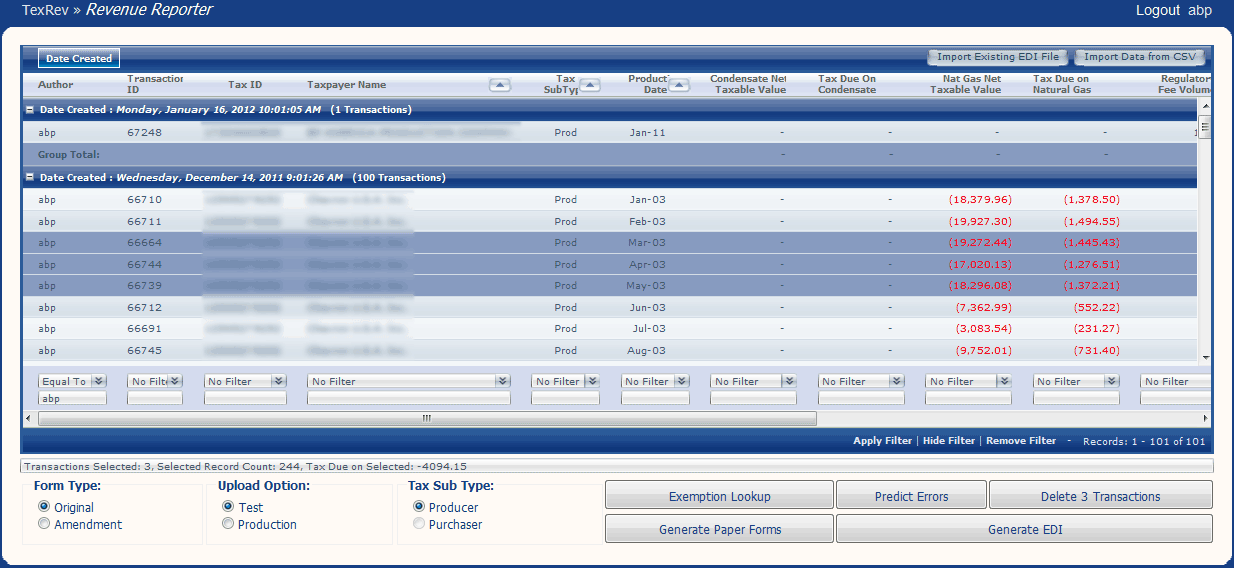

The EDI Generator is TexRev's module for processing EDI files and their related data. The Revenue Reporter page is the main dashboard for these functions.

There are three categories of actions you can perform from this page: Revenue Import, Revenue Analysis and EDI Report Creation

Revenue Reporter offers a couple of methods to import revenue to be reported to the State.

•Import Data from a CSV file - Data can from a variety of user specified tables structures, regardless of columns headers and ordering. TexRev can even populate missing required fields based on values in available fields. •Import an existing EDI file - Evaluate natural gas EDI revenue from any source. |

Once data is imported, there are a number of ways Revenue and Reporter can provide information about it. You can view instant summary information on a transaction level, look up available exemptions and discover records that may cause data-changes or errors in the State's system.

Summary Information

The Transaction Grid can be used to look up the net revenue and production number impact of your transactions, individually or on an aggregate level.

Sometimes you have existing EDI files for which you'd like to verify the contents, test for errors or check for missed exemptions before submission. You can import these often cryptic files and view the Transaction Grid to learn more about their contents.

See Navigating the Transaction Grid to learn more.

Look Up Available Exemptions

Manually looking up available exemptions for your reported revenue can be a tedious and inefficient process, especially given how small a tax impact an exemption might yield in a particular production month. There are so many organizations involved in reporting on an ever growing list of leases, that often a taxpayer is not aware that another entity filed and received approval on a lease exemption that the taxpayer is reporting on. TexRev's Exemption Lookup function has recovered millions of dollars in severance taxes on behalf of Shiv Om's clients. We offer it to you as an included component of TexRev on a go forward basis.

Simply select the transactions from the Transaction Grid that you'd like to evaluate for potential exemptions and click the Exemption Lookup Button.

The Revenue Reporter will ask you to confirm that you want to run the report for the selected transactions. Click OK and TexRev will generate and return your dynamic Exemption Lookup Report.

Preventing Data-Changes and ErrorsTexRev's Predict Errors function is designed to mimic the error detection and data change process a record goes through when submitted to the State.Catching and correcting any issues before EDI file submission can mitigate two major nuisances:

•The divergence of your company's in-house financial records versus those recorded by the State •The complicated and often lengthy error correction process

To screen your revenue for these potential errors, select the target transactions from the Transaction Grid and click the Predict Errors Button.

The Predict Errors module is covered in the Error/Datachange Prediction Options section. |

There are three ways to amend or report revenue to Texas Severance Tax system: upload a digital file to the State's Natural Gas EDI Submission Page, submit a paper report or call your adjuster directly to make a manual adjustment (there are times when this is required).

Digital Files (EDI)The state requires that any major severance taxpayer report their natural gas revenue by uploading EDI files. TexRev's EDI file generator provides a simple and quick way to create EDI files with little initial setup.Even though some Taxpayers have integrated systems creating and submitting the EDI files for them, most companies do not have a convenient method to make corrections or spot adjustments when their system creates problems. For avoiding compliance and financial record matching headaches, TexRev's EDI file generator is still the easiest way to make these adjustments.The method of creating the EDI file from the Revenue Reporter is covered under Generating an EDI File.

Paper ReportsThough in most cases the State requires digital revenue submissions, many taxpayers still like to keep the tax forms for archival purposes. In addition to creating EDI files, TexRev allows you to use imported revenue data to create paper forms. However, only Original Producer Reports are implemented at this time.

Note: TexRev will not prevent you from creating paper reports from purchaser and/or amendment records.

To generate the forms for a hard copy report, select the target transactions from the Transaction Grid and click the Generate Paper Forms Button.

The Revenue Reporter will ask you to confirm that you want to run the report for the selected transactions. Click OK and TexRev will return a viewer page for your tax forms.

Manual Entries by the Accounts ExaminerIn some cases, it is not possible for you to correct or even amend a record via EDI.

For example, records exist on periods prior to April, 2008 that can not be submitted today without a incurring a datachange. Often, amendments made to these records get datachanged before they are able to hit the target record. Without the help of the State, you may end up with a big mess of multiple records in error status.

In cases like this, you have to call your Accouncts Examiner at the State to make the corrections for you. Fortunately, TexRev's Predict Errors feature will let you know when this is the case. |

To delete transactions once you are through with them, select the target transactions from the Transaction Grid and click the Delete X Transactions Button. The button will always indicate how many transactions you are about to delete. Revenue Reporter will ask you to confirm that you want to delete the selected transactions. Click OK to commit the deletion. |