| Show/Hide Hidden Text |

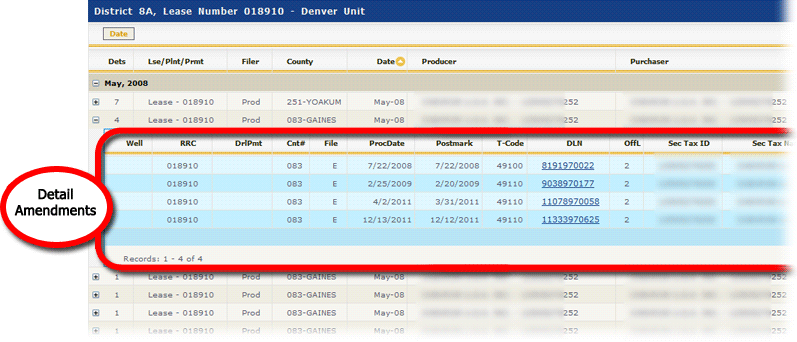

A Detail Record Subreport lists the detail original and amendment filings that make up a summary record in the Lease Revenue Report.

To open one of these subreports,click on the Plus Icon ![]() in the Det field of a summary record. To collapse the report, click on the Minus Icon

in the Det field of a summary record. To collapse the report, click on the Minus Icon ![]() .

.

The subreport is ordered by processing date, postmark date and DLN; the order it entered the State's system.

There are thirty six fields available for each detail record:

•Well - The Well ID •RRC - The Lease ID •DrlPmt - The Permit ID, may be populated instead of the RRC •Cnt# - County Code •File - Filing Method, E denotes Electronic filing while S denotes State automated filing. If the field is blank, that means a manual filing was made by someone at the State. •ProcDate - Processing Date •Postmark - Postmark date of filing •T-Code - Transaction Code •DLN - Document Locator Number •OffLse - Off Lease Sale Indicator, 1 for Yes, 2 for No •SecTaxID - Secondary Taxpayer ID •SecTaxName - Secondary Taxpayer Name •Typ - Lease Type Code, 1 for Oil, 2 for Gas •Ex - Two digit Exemption Type Code. See the Exemptions Section in the Appendix for code definitions •CM# - Commodity Code Number. See the Commodities Section in the Appendix for number definitions •API - 8 digit API number •TXBL - Indicates whether the reporting Taxpayer is liable for tax, 1 for Yes, 2 for No •lsVol - Gross Lease Volume reported on the commodity, M.C.F for gas, barrels for condensate •yourVol - Volume of gas not subject to tax because of a governmental exempt status •yourVal - Value associated with yourVol •exVOL - Royalty Volume exempt from tax •exVAL - Value associated with exVOL •COST - Reported marketing costs incurred •NetTaxVal - Net taxable value of the product sold •TxDue05 - Tax Due on High Cost Record. Only used with Exemption 05 (High Cost) records •Rate - The tax rate applied against the net taxable value. Only used with Exemption 05 (High Cost) records •Reim - Indicates whether tax reimbursement is included in calculating the value on this lease. Value is 1 for Yes or 2 for No •LocNum - The seven digit locator number reported on the summary record. Locator numbers are unique by Taxpayer, Tax Sub Type and Filing Period •Errors - Error Codes, if any, tripped by this latest amendment •Dis - District in which this lease exists •County - County Name •Chk - Check Digit, this field has been depricated from the old system •LeaseName - Name of the Lease •CM - Abbreviation of the commodity being reported. See the Commodities Section in the Appendix for definitions •ExErr - Exemption Setup Error •LsEndDate - Lease End Date |

Each Detail record is submitted as part of a transaction, usually along with a set of other detail records. Often, It can be useful to view the transaction to understand the reasoning behind whatever the detail record is doing. For instance, if an amendment backs out a summary record's values completely, you might find in the transaction that the revenue was booked somewhere else. TexRev provides a simple, but powerful feature for looking up that relevant transaction.

To view all the records in the transaction with which a detail record was submitted, click on the detail record's hyperlinked Document Locator Number. TexRev will present the adjustments in an Account Detail Report. |