The Lease Revenue Report is the grid within the Lease Revenue Page. The report lets you view lease records at a summary (adjusted total) level and drill down to the detail adjustments.

The Lease Revenue Report works much like other grids in TexRev, with features such as grouping, sorting, filtering and selecting. See the Using Grids in the Appendix for a detailed explanation of how TexrRev's Grids work. Features unique to the Lease Revenue Report are described below.

TexRev limits the contents of the grid to records your group is authorized to view; that is, any record that contains one of your Taxpayer IDs as the primary or secondary taxpayer. TexRev will also limit the contents of the grid by any settings from the referring page. For example, if you navigated here from the Revenue Summary Page, which was configured to only show revenue for the commodity raw gas in Anderson County, the Lease Revenue Report will also only show raw gas records reported in Anderson County. |

Each record in the Lease Revenue Report represents a summary record. There are twenty-five fields available for each record:•Dets - The number of adjustments, including the original filing, making up the adjusted total values. The Plus Icon •Lse/Plnt/Prmt - The type of ID and the number. The number can be a Lease ID or a Drilling Permit Number. •Filer - The record's tax subtype, one of two values: oProd - Producer Reported (49) oPurc - Purchaser Reported (37) •County - The County Number and County Name where the record is reporting •Date - The filing period in which the record is reported - formatted by a three letter month abbreviation and two digit year number •Producer - The producing taxpayer's name and ID •Purchaser - The purchasing taxpayer's name and ID •Type - The Lease Type the record is reported on, Oil (1) or Gas (2), followed by two digit reported exemption code (if any) •CM - Indicates the commodity being reported. Consists of the commodity abbreviation followed by commodity code. •API - API (America Petroleum Institute) Number consisting of 8 digits •TXBL - Tax Liability of reporting entity - Yes or No. •lsVol - Gross Lease Volume reported on the commodity - MCF for gas, barrels for condensate •yourVol - Volume reported •yourVal - Value associated with yourVol •exVOL - Volume of gas not subject to tax because of a governmental exempt status •exVAL - Value associated with exVOL •COST - Reported marketing costs incurred •NetTaxVal - Net taxable value of the product sold •Tax Due - Tax due to the State. TexRev calculates this field. •Rate - The tax rate applied against the net taxable value. Only used with Exemption 05 (High Cost) records. •Reim - Indicates whether tax reimbursement is included in calculating the value on this lease. Value is Yes or No. •Loc Num- The last seven digit locator number reported on the summary record. Locator numbers are unique by Taxpayer, Tax Sub Type and Filing Period. Though a locator number will indicate a unique summary record, a summary record's details can contain multiple locator numbers. See Locator Number Merges in the Appendix to learn more •Err - Indicates whether the record is in error status. Value is Yes or No. |

The records in the Lease Revenue Report are initially grouped by the Date field, but that grouping can be removed and other fields can be added. Group By fields remain in the column header list. |

By default, the summary records are sorted by Date . You can resort the records any way you like. |

If the referring page is the Full Revenue History Page, then the report is filtered by the referring summary record's production date. You may remove and add filter settings as desired.

By default, TexRev displays summary records that are zeroed out (backed out completely. These records are still included for trail searching purposes). To remove them from view, click the Hide Zeroed Out check-box in the upper right part of the grid.

|

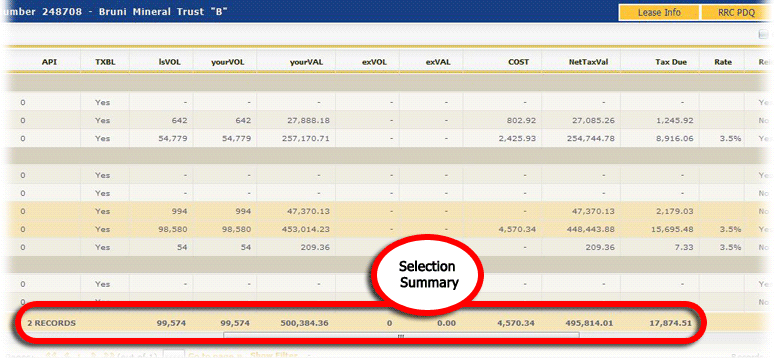

The Selection Summary Row is located at the grid's page footer. It displays a running total of all selected Summary Records.

The row displays the number of summary records selected. It will also show a running total of the following fields:

•lsVol* •yourVol •yourVal •exVOL •exVAL •COST •NetTaxVal •Tax Due * The total for Gross Lease Volume is often meaningless, as only the physical operator is supposed to report it. In-kind producers often violate the rule, since the State rarely enforces it, rendering the total Gross Lease Volume irrelevant. Use the RRC PDQ Lookup instead for more accurate total production comparisons. |

To view the detail adjustments making up a summary record, click on the Plus Icon

|