| Show/Hide Hidden Text |

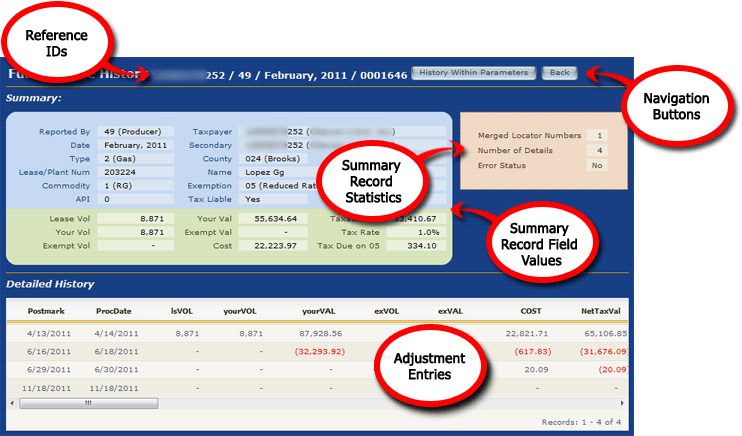

The Full Revenue History page is used to show the history for a single summary record.

It is divided into three sections:

The Reference section displays lookup parameters and navigation buttons

Identity Values

Next to the Page Title, "Full Revenue History", you'll find the four values that TexRev used to identify the summary record.

In order from left to right, the fields used are:

1.Reporting Taxpayer ID 2.Tax Subtype 3.Production Month 4.Locator Number

Navigation Buttons

There are two navigation buttons available:

•History Within Parameters - Use this button to view the summary record in the context the lease's other activity on its Lease Revenue Page. By default, the Lease Revenue Page will be filtered by the summary record's production month. •Back - TexRev will navigate you back to the Full Revenue History's referring page. We advise you to use this method rather than using the back function of your browser. |

The Summary section displays the summary record's values and statistical information. Summary Record Field Values

There are twenty five field values for the summary record available, They are organized by Text Field Values (the blue section) and Numerical Field Values (the green section)

Text Field Values

The blue section of the summary record shows its key fields and and non-numerical values. These values are dictated by the last detail record (or adjustment) to specify a value for that field. The fields displayed are:

•Reported By - Producer (49) or Purchaser (37) reported •Taxpayer - Reporting taxpayer ID and name •Date - Filing Period •Secondary - Secondary Taxpayer ID and name when applicable or Off Lease Sale •Type - 1 (Oil) or 2 (Gas) •County - three digit code and name •District - Comptroller designated district of county •Lease/Plant Num - lease ID or permit number •Name - Lease Name •Commodity - Code and two character abbreviation •Exemption - Two digit code and description •API - API number, if provided •Tax Liable - Reporting taxpayer's liability of tax - Yes or No •Tax Reim - Whether Tax Reimbursement is built into the reported values - Yes or No

Numerical Field Values

The green section of the summary record shows the adjusted totals of the volume and value fields. These values are calculated by summing up the values in the detail records. The fields displayed are:

•Lease Vol - Gross Lease Volume reported on the commodity, MCF for gas, barrels for condensate •Your Vol - Volume of gas not subject to tax because of a governmental exempt status •Exempt Vol - Royalty Volume exempt from tax •Your Val - Value associated with yourVol •Exempt Val - Value associated with Exempt Vol •Cost - Reported marketing costs incurred •Taxable Vol - Net taxable value of the product sold •Tax Rate - The tax rate applied against the net taxable value. Only used with Exemption 05 (High Cost) records •Tax Due on 05 - Tax Due on High Cost Record. Only used with Exemption 05 (High Cost) records

Summary Record Statistics

This red section contains statistical information about the summary records. It displays the following fields:

•Merged Locator Numbers - Displays how many unique locator numbers exist in the detail records. If the value is more than one, TexRev detected a locator merge during the record's progression. To learn more more, see the section on Locator Number Merges in the Appendix. •Number of Details - The number of total adjustments made on the summary record, including the original report. •Error Status - Shows what error codes the summary record is currently carrying. If the record is not in error status, 'No' is displayed. |

The Detailed History shows the detail records of the summary records. TexRev determines the order in which the State processed them and sorts the detail records accordingly. There are thirty-six fields available. See Detail Report Fields on the the Navigating the Detail Reports page to see field explanations.

|