| Show/Hide Hidden Text |

The Revenue Summary Report is the grid within the Revenue Report Page that lets you view reported revenue on a lease level. TexRev summarizes the revenue within the specified parameters. That is, if you limit your request to a single commodity, only that commodity's revenue will be displayed.

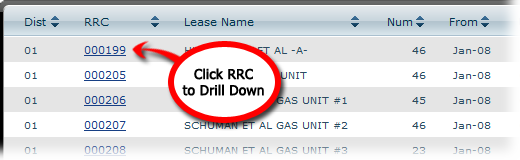

Each record describes a Lease, identified by a District/RRC number pair (RRC assigned leases are only unique by District), along with various information about the revenue reported on that lease. The report works much like other grids in TexRev, including features such as sorting, filtering and selecting. See the Grids Section in the Appendix for a detailed explanation of how TexRev Grids work. You can also drill down a line item to see the records behind a summary.

•Dist - Comptroller's District Code for the lease

•RRC - Comptroller's 6 digit code for the lease, usually the Railroad Commissions's Lease ID, but it can also be a drilling permit number, a suspense lease, or a number assigned by the Comptroller for reporting on an entire unit. The value is hyperlinked for drilling down purposes.

•Lease Name - Name assigned to the lease by the Railroad Commission

•Num - The number of revenue records reported on the lease within the parameters selected

•From - The earliest reported Production Date on the lease within the parameters selected

•Until - The latest reported Production Date on the lease within the parameters selected

•ExRpt - How many records reported with an exemption 03 or 07 on the lease within the parameters selected. TexRev provides a count rather than total net taxable value since these records have zero impact on the latter.

•NG NetTax - The total net taxable value reported on nonexempt, non-condensate records on the lease within the parameters selected

•NG Tax - The total tax due value reported on nonexempt, non-condensate records on the lease within the parameters selected

•CN NetTax - The total net taxable value reported on condensate records on the lease within the parameters selected

•CN Tax - The total tax due value reported on condensate records on the lease within the parameters selected

•RT(avg) - Tax Rate reported on High Cost records on the lease within the parameters selected. If multiple tax rates are reported, this value is averaged.

•Total Tax - The total taxes reported on the lease within the parameters selected

•Err - Count of records tagged as in error status on the lease within the parameters selected

•YourVol - The total volume reported on the lease within the parameters selected

•YourVal - The total value reported on the lease within the parameters selected

•exVol - The total exempt volume reported on the lease within the parameters selected

•exVal - The total exempt value reported on the lease within the parameters selected

•Cost - The total cost reported on the lease within the parameters selected

•exVol - The total exempt volume reported on the lease within the parameters selected

•NetTaxabl - The total net taxable value reported on the lease within the parameters selected