Tax Sub Type is a required parameter for a revenue search. It specifies what kind of search the user would like to do using the selected Target Taxpayers.

For each record on the State's Natural Gas Revenue system, there are two taxpayer fields and Sub-Type field. The Tax Sub Type field indicates whether the record is a producer (49) or purchaser (37) report. The first taxpayer field (Taxpayer Number) specifies the reporting Taxpayer ID and the other (Secondary Taxpayer Number) specifies the Secondary Taxpayer ID.

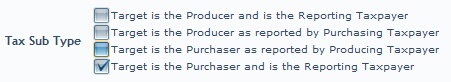

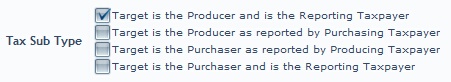

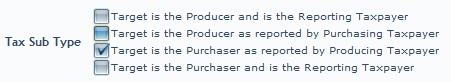

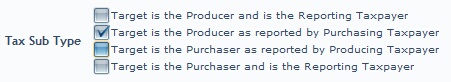

In terms of a TexRev revenue search, you must specify by which fields you want to limit your Target Taxpayer IDs. TexRev offers four different variations of field searches, of which you must select one or more.

If you are looking for records where your Target Taxpayer is reporting as a producer, select the first option:

If you are looking for records where other producers reported your Target Taxpayer as the purchaser, select the third option:

If you are looking for records where a purchaser reported on your Target Taxpayer's behalf, select the second option.

If you are looking for records where your Target Taxpayer is reporting as a purchaser on the behalf of a producer, select the third option.