To generate an EDI file,

1.Select the target transaction(s) from the Revenue Reporter's Transaction Grid.

2.Select the target Form Type, Original or Amendment.

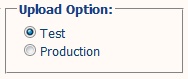

3.Choose between Test and Production EDI file from the Upload Option.

4.TexRev will choose the appropriate Tax Sub Type from Producer and Purchaser. You cannot create an EDI file with both types of records.

5.Click Generate EDI.

![]()

6.TexRev will ask you to confirm the creation of the EDI report. Click OK to commit

![]()

TexRev will start generating the EDI file. If TexRev does not find any duplicate entries to the same summary record, it will begin generating the EDI file. Upon a successful completion, TexRev will provide a button that you can click to download your file.

![]()

You can transmit the downloaded file to the State's Natural Gas EDI Submission Page found at:

http://www.window.state.tx.us/taxinfo/etf/transmitedi.html

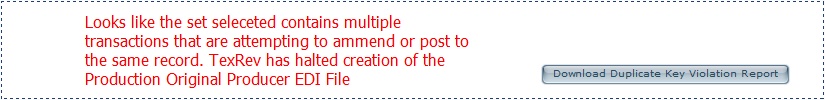

If TexRev finds that more than one selected transaction is attempting to report on the same summary record, TexRev will abort the EDI File generation and return a Duplicate Key Violation Report.

At this point, you have two options to successfully create an EDI file:

1.Resolve the duplicate key violation. Find the two amendments and establish why you are reporting on the same record twice. If they are duplicate entries, remove one entry, otherwise combine the two into one record.

2.Create an individual EDI File for each transaction. We strongly recommend against this option until you have established the a legitimate reason for the separate entries.