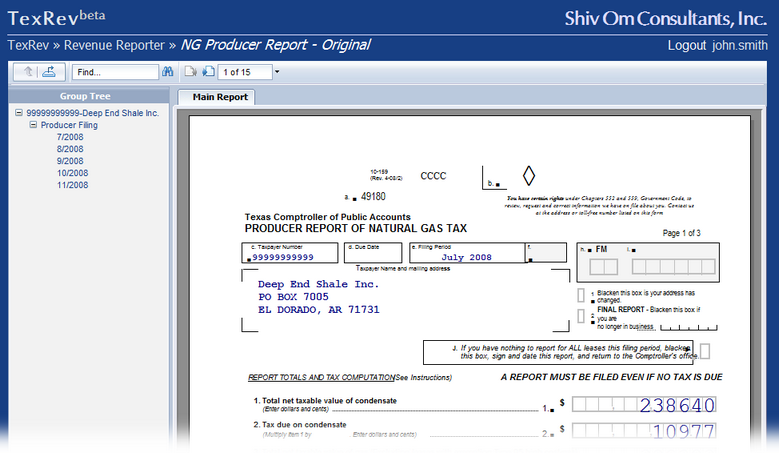

Once you create the paper report, you will be presented with a screen similar to the image following. You have the ability to navigate around the report by page, by group or by text search. You can also drill down the report and export it to various formats. To return to one of the previous web pages, click on TexRev at the top of the page to return to the main index, or click on Revenue Reporter to return to the Revenue Reporter page.

Use the page left and right icons to navigate the report page by page.

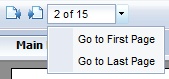

You can also type the number of the page you'd like to navigate to in the page number box and press return. Click the down arrow next to the page numbering box to bring up options for navigating to the first and last page.

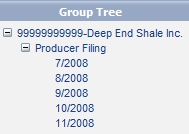

The Group tree pane shows you an outline of the report with nodes by Reporting Taxpayer ID, by Subtype, by Filing Period.

Click on any node to navigate directly to its page. You can collapse a node by clicking its minus icon or expand it by clicking its plus icon.

To search the report for any text, type the text into the search box and click the Search For Text icon.

![]()

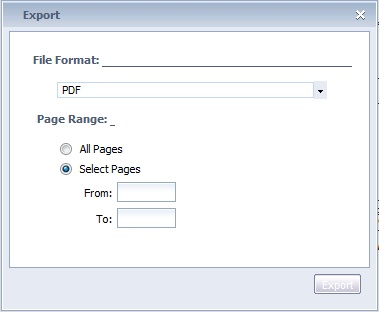

Press the Export Button ![]() to export the current report. This will bring up the Export dialog box.

to export the current report. This will bring up the Export dialog box.

You can select the page range of the report to print. You can also specify one of the export file formats from the list below:

•Crystal Reports (RPT)

•Microsoft Excel (97-2003)

•Microsoft Excel (97-2003) Data-Only

•Microsoft Excel Workbook Data-only

•Microsoft Word (97-2003)

•Microsoft Word (97-2003) - Editable

•Rich Text Format (RTF)

•Character Separated Values (CSV)

•XML

Note: We recommend using the PDF format for record keeping as it is the best for accurately reflecting what you see on the screen.