Select this category to verify submitted calculations for tax to be paid on each record.

Warnings Returned

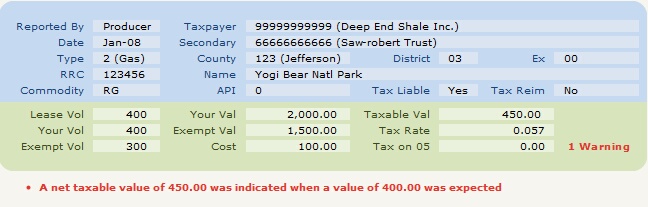

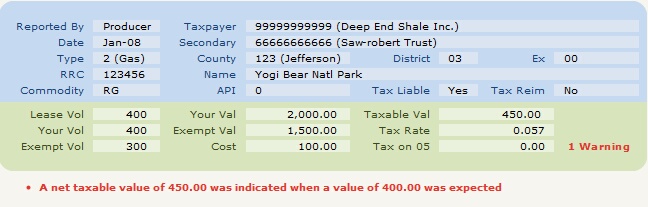

A Net Taxable Value of X.XX was indicated when a value of X.XX was expected

Code: NtTxClc

Description: Message returned if TexRev calculates a net taxable value that is different than the value submitted. The message will also contain the amount that the application was expecting. For Amendment Error Checking, TexRev will check its calculation against the result of your amendment. If the net taxable value of the record being amendment was wrong to begin with, you'll have have to edit your submitted record accordingly.

Net Taxable Value should be Your Value - Exempt Value - Cost.

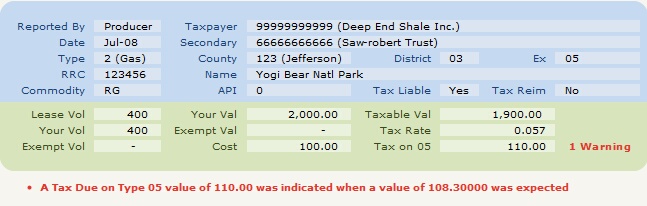

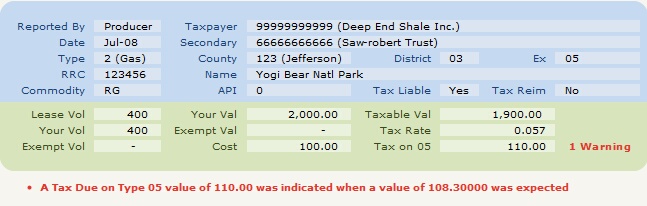

A Tax Due on Type 05 Value of X.XX was indicated when a value of X.XX was expected

Code: Tx05Clc

Description: Message returned if TexRev calculates a Tax Due on Type 05 Value that is different than the value submitted. The message will also contain the amount that the application was expecting. For Amendment Error Checking TexRev will check its calculation against the result of your amendment. If the net taxable value of the record being amendment was wrong to begin with, you'll have have to edit your submitted record accordingly.

Tax Due on Type 05 should be the Net Taxable Value multiplied by the Tax Rate.