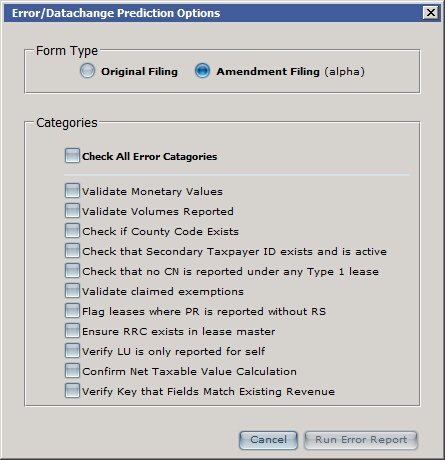

TexRev offers several options before running the error report. Once you've specified your options, click Run Error Report to generate a list of potential data changes and errors.

TexRev offers you the ability to treat a target transaction as an Original Filing or Amendment Filing.

Selecting the option for Original Filing tells TexRev that these records do not already exist on the State's Revenue database. Any processing by TexRev will focus on validating the contents of the records only.

Selecting the option for Amendment Filing tells TexRev that a target transaction's records are updating existing records on the State's Revenue Database. Before checking the records, TexRev will attempt to find the summary record that your submitted record is amending, and calculate the result.

To locate the target record, TexRev will default to (if imported) the Locator Numbers first, then the Primary Key Fields.

TexRev will then run it's error checking on that result of the amendment and the existing record.

TexRev offers you the ability to choose which types of errors you'd like to look for in your report. This can be useful for fixing one type of error all at once, or filtering out checks that don't concern you. You must check at least one of the following optional categories to run the report:

•Validate Monetary Values critical

•Check if County Code Exists critical

•Check that Secondary Taxpayer ID Exists and is Active

•Check that No CN is Reported Under Any Type 1 Lease critical

•Validate Claimed Exemptions Flag Leases Where PR is Reported Without RS

•Ensure RRC Exists in Lease Master critical

•Verify LU is Only Reported for Self critical

•Confirm Net Taxable Value Calculation critical

•Verify That Key Fields Match Existing Revenue only enabled for Amendment Filing Checks

Not included in the optional categories list is the Category for Possible Data Changes. Data Change checks are mandatory for Error Reports.

Note: The Run Error Report button will not be enabled unless at least one optional category is selected.