| Show/Hide Hidden Text |

The Account Detail Report is the grid within the Account Detail Page; it lets you view reported revenue on a transaction entry level. TexRev summarizes the revenue within the specified parameters. That is, if you limit your request to a single commodity, only that commodity's revenue will be summarized within each transaction entry.

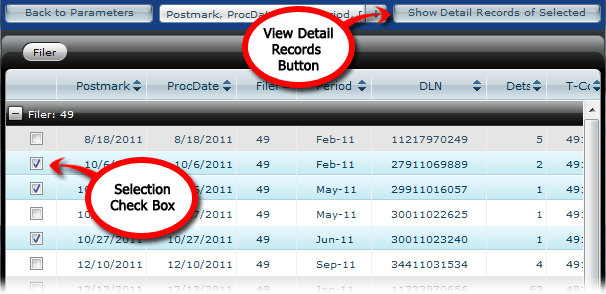

Each record represents a transaction entry, identified by a set consisting of a unique DLN, filing method, postmark date and processing date (to keep in line with the way the State displays information in their Account Detail report), along with various information about the revenue reported within that set. The report works much like other grids in TexRev, with features such as sorting, filtering and selecting. See the Grids Section in the Appendix for a detailed explanation of how TexRev Grids work. In addition, you can also:

•Remove and restore fields from the grid view

•Drill down one or more line item to see the underlying detail adjustments (also known as detail records)

•Postmark - The date the Comptroller received the transaction

•ProcDate - The date the comptroller processed the transaction

•Taxpayer - The reporting taxpayers ID and name

•Filer - The record's tax subtype, one of two values:

oProd - Producer Reported (49)

oPurc - Purchaser Reported (37)

•Period - Production Date of transaction

•Dets - The number of amendments within the transaction

•File - The filing method of the transaction

o'E' - Electronic Filing

o'R' - RCS Return

o'S' - System Generated

o'T' - Telefile

oblank (' ') - manual adjustment by State

•T-Code - Transaction code

•NG NetTax - The total net taxable value impact of the transaction entry on nonexempt natural gas

•NG Tax - The tax impact of the transaction entry on nonexempt natural gas

•CN NetTax - The total net taxable value impact of the transaction entry on condensate

•CN Tax - The tax impact of the transaction entry on condensate

•5 NetTax - The total net taxable value impact of the transaction entry on high cost gas

•5 Tax - The tax impact of the transaction entry on high cost gas

•Total Tax - The total tax impact of the transaction entry

•Err - Number of adjustments records in the transaction entry that created an error notice

•ExRpt - Number of records reported with an two or three year inactive exemption

•InactiveVal - total your value of ExRpt

•lsVOL - total lease volume reported in transaction entry

•yourVOL - total your volume reported in transaction entry

•yourVAL - total your value reported in transaction entry

•exVOL - total government royalty volume reported in transaction entry

•exVAL - total government royalty value reported in transaction entry

•COST - total cost reported in transaction entry

•NetTaxVal - total net taxable value reported in transaction entry

Click on the check boxes of any fields you want to toggle, and they will disappear or reappear from the grid. The report preserves your settings through paging, filtering, grouping and sorting; however, refreshing or returning to this page from another page will reset the Field Drop Down List to default.