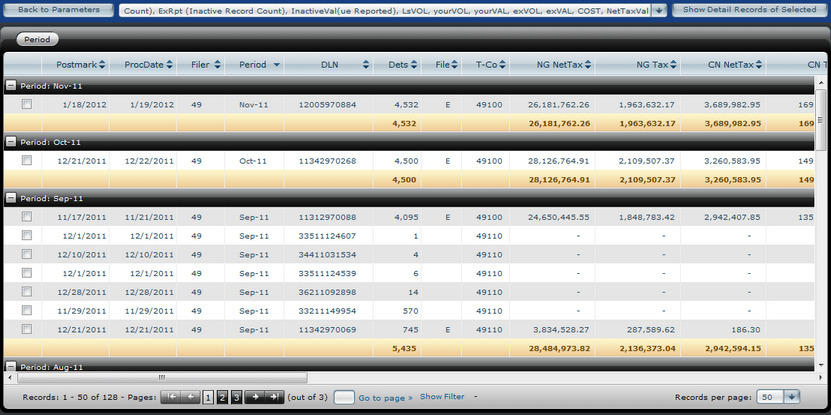

The Account Detail Page contains a report of revenue summarized on a transaction / filing method / postmark date / processing date basis. We refer to each line item as a transaction entry. We designed it primarily for the purpose of reconciling company books with the State's records. It is designed to parallel the data received from the Comptroller's Account Detail reports and is useful for analyzing your companies' revenue reporting time-line. You can use it to complete tasks such as:

•Isolate and research system generated or manual adjustments by the State's account examiners (filter by Filing Method).

•Compare what your company uploaded to what ended up getting processed on the State's system (filter by postmark date).

•Look up the entire trail for a particular adjustment (filter by DLN)

The page contains the Account Detail Report, a grid displaying revenue within the user's specified options from the Revenue Parameters page summarized by transaction entries.

Keep in mind that your specified parameters affects the data summarized within each transaction entry. For example, if your parameters specify a particular lease, the summarized values for each transaction entry in the report will reflect only the values of that lease, rather than the total value of all adjustments in the transaction.

From the Account Detail Page, you can:

•View the Account Detail Report

•View the actual adjustments of specified transaction entries on a Detail Report Page

•Return to the Revenue Parameters Page by clicking the Back to Parameters Button