| Show/Hide Hidden Text |

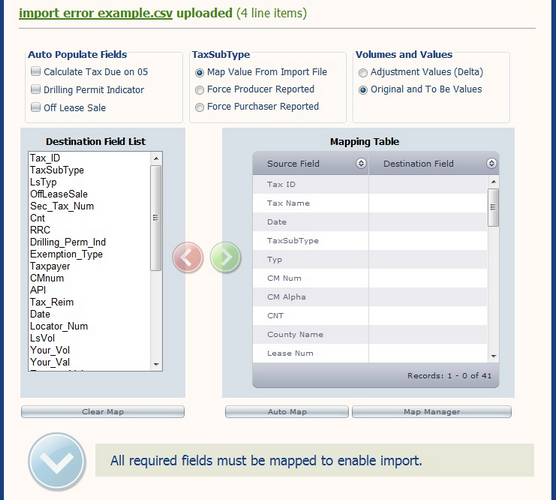

When a CSV file is uploaded, TexRev displays the number of records uploaded, and analyzes the structure of the table and offers multiple options on how to map and process the source fields during import.

TexRev does not require your import fields to have the same names as those its own database, but you must specify which of your field names should map to TexRev's field names. There are up to 32 available destination fields. Depending on your options configuration, the import requires that you map most of these fields before you may successfully import your file. Fortunately, the CSV Import Options provides several functions to make the process less painful, among them the Auto Map and the Map Manager.

TexRev requires you to provide data for multiple fields during import. Sometimes your data source is not set up to provide each and every field during export. You can utilize the Auto Populate Field Options to direct TexRev to make assumptions about the values of several of the required fields. The application computes the values based on the makeup of other appropriate fields. Enabling an Auto Populate Field option removes its affected fields from both the Destination Field List and the Mapping Table.

Note: If you have already mapped the affected field, you will lose that mapping.

You can enable an Auto Populate Field Option by toggling the appropriate check box. Calculate Tax Due on 05

Fields Affected:

•TaxDueOn05 •ToBe_TaxDueOn05* •Tax_Rate

Description:

When importing Exemption Type 05 records, TexRev will attempt to populate the Tax Rate field by looking up the exemption certificate matching the county and lease number of the record. If no Type 05 exemption certificate can be found, the Tax_Rate field gets assigned a value of -100% (-1). TexRev uses this Tax Rate against the Net_Taxable_Val to calculate the TaxDueOn05 field, and the ToBe_Net_Taxable_Val to calculate the ToBe_TaxDueOn05 field.

* ToBe_TaxDueOn05 is only calculated when Original and To Be Values is specified under the Volumes and Values option. Drilling Permit Indicator

Fields Affected:

•Drilling_Perm_Ind

Description:

TexRev will populate the Drilling_Perm_Ind based on the value in the RRC field. If the RRC number begins with a 5, 6, 7, or 8, TexRev assumes that the value is a permit number and will populate the drilling permit indicator with a value of 1 (Yes). Otherwise, it populates the field with the default value of 2 (No).

Off Lease Sale

Fields Affected:

•OffLeaseSale

Description:

TexRev will populate the OffLeaseSale field based on the values in TaxSubType and Sec_Tax_Num (Secondary Taxpayer Number) field. If the Secondary Taxpayer Number is specified as '0', '00000000000' or '44444444444', then TexRev assumes that Off Lease Sale should be 1 (Yes). Otherwise, it populates the field with the default value of 2 (No). |

One of the required fields for import is TaxSubType, which indicates whether the reporting taxpayer is the producer or purchaser. You have the ability to force the value of TaxSubType for every record in your import with the TaxSubType Options by selecting one of the following radio buttons:

•Map Value From Import - Select this option if you are importing a field for TaxSubType. •Force Producer Reported - Select this option if your source table does not have a TaxSubType field and you want to force a value of 49 (Producer Reported) for each record. •Force Purchaser Reported - Select this option if your source table does not have a TaxSubType field and you want to force a value of 37 (Purchaser Reported) for each record. |

This option specifies whether your import file will be utilizing To Be fields for volumes and values and expect TexRev to calculate the difference. By utilizing To Be fields, you may retain the original values of your records in the original (or reported) fields, and populate the target values in the To Be fields. TexRev can use this set to create the correct adjustment record for the EDI file.

By default, the Adjustment Values (Delta) radio button is selected. To use To Be fields, select the Original and To Be Values radio button. |

Mapping a Single Field

1.Select the destination field from the mapping table. TexRev will try to automatically select the closest match from the Destination Field List. If it selects the correct Destination Field, move on to Step 3. 2.Select the destination field to be mapped from the Destination Field List. If one source field and one destination field have been selected the Map button will become enabled. 3.Click the Map Field button.

Un-Mapping Fields

Select one or more mapped fields from the Mapping Table, then click the Unmap Button to clear the mapping.

Note: If any selected rows in the Mapping Table do not have a destination field selected, the Unmap Button will be disabled. |

Clear Map button removes all the destination fields from the Mapping Table and resets the Destination Field List. TexRev will repopulate the Destination Field List based on the current option settings. |

The Auto Map button attempts to map existing source fields and destination fields. It will only map two fields if their names are exactly the same.

Note: Auto Map does override any existing mappings. |

Use the Map Manager button to show the Map Manager. There you can save your current import options for later use or retrieve previously saved settings. |