Select this category to validate exemptions taken on reported revenue.

Warnings Returned

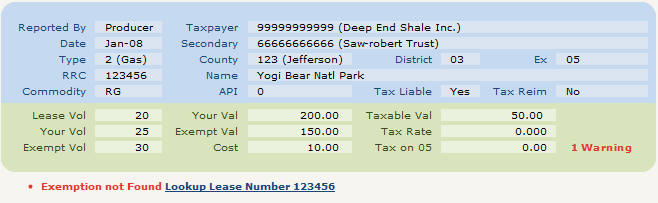

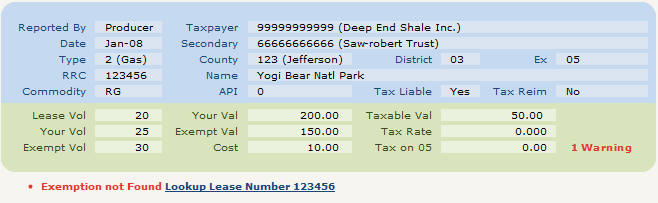

Exemption not Found Lookup Lease Number XXXXXX

Code: Ex_Not

Description: Message returned if there is no exemption reported to the Comptroller for the lease number, county and lease type provided. By clicking on the underlined hyperlinked portion of the warning message, you can open the record's Lease Info page. There you can look up which, if any, exemptions are applicable.

If no exemption is found, it does not necessarily mean the lease is not exempt. It just means the Comptroller does not have it entered in its Natural Gas System. If you can verify that the exemption is approved by the Texas Railroad Commission, call your adjuster at the Comptroller's Office to get the exemption registered.

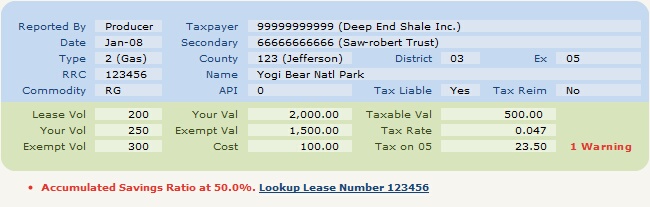

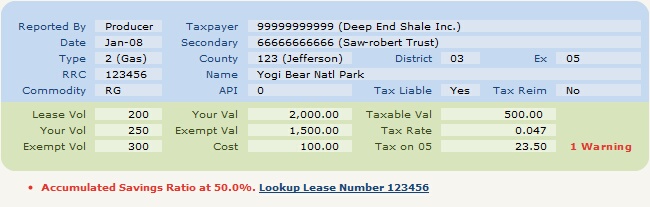

Accumulated Savings Ratio at X%. Lookup Lease Number XXXXXX

Code: EX_50

Description: Message returned if over 50% tax savings has been claimed on the reported high cost exemption as a result of your amendment. By clicking on the underlined hyperlinked portion of the warning message, you can open the record's Lease Info page. There you can drill down to the relevant high cost exemption and find the current savings ratio.

If the current savings ratio for the exemption is already 50%, you may need to report this record without an exemption. Otherwise you could try reporting less revenue under Type 05 Exemption and the remaining under nonexempt.

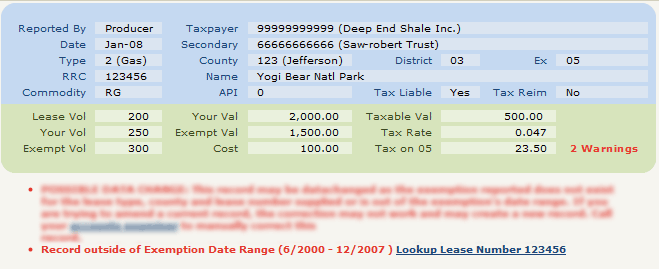

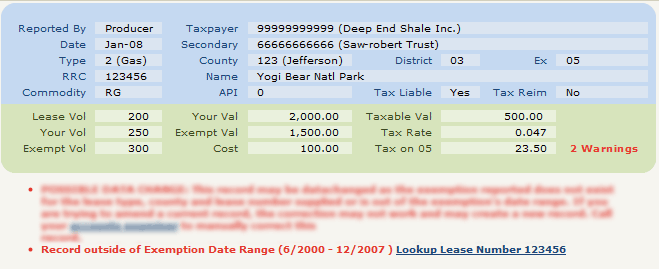

Record outside of Exemption Date Range (X/XXXX - X/XXXX ) Lookup Lease Number XXXXXX

Code: Ex_Dat

Description: Message returned if the indicated exemption does exist for the lease being reported, but the production month (Date) reported is outside of the exemption's valid date range. The error code does return the applicable date range. By clicking on the underlined hyperlink portion of the warning message, you can look up more information about the lease in question to learn which, if any, exemptions are applicable.

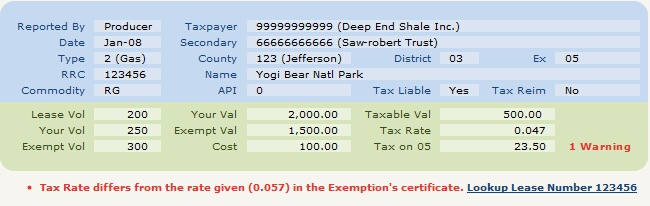

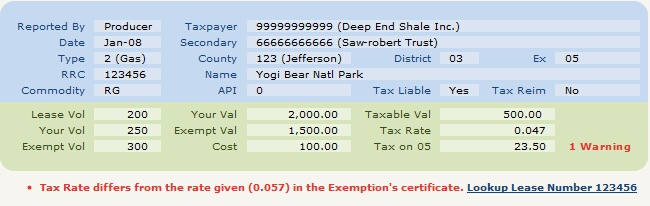

Tax Rate Differs from the Rate Given (X.XXX) in the Exemption's Certificate. Lookup Lease Number XXXXXX

Code: EX_Rate

Description: Message returned if the High Cost Exemption referenced does exist, but the tax rate reported does not match the tax rate recorded in the Exemption Certificate at the Comptroller's office. The error message should contain the the correct tax rate. By clicking on the underlined hyperlink portion of the warning message, you can open the record's Lease Info page.

To correct this error, update the tax rate in your import file and upload it again.

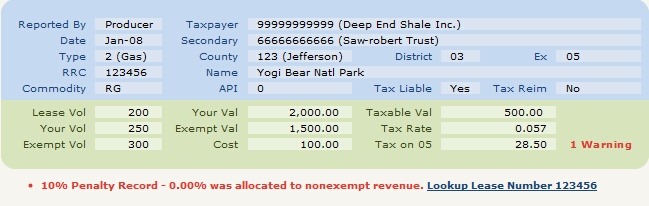

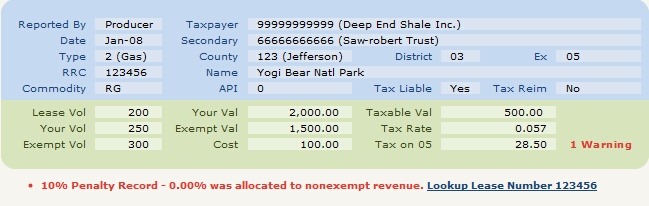

10% Penalty Record - X.XX% was allocated to nonexempt revenue. Lookup Lease Number XXXXXX

Code: EX_10%

Description: Message returned when your exempt record reported is within the ten percent penalty window, but 10% of value reported is not in a nonexempt record.

TexRev will also return what percentage of Your Value is allocated to lease's nonexempt record within your transaction. For Amendment Filings, TexRev will calculate the percentage based on the predicted result of your entire transaction.