| Show/Hide Hidden Text |

While importing a CSV file, TexRev scans the mapped fields for missing or invalid values. If it finds any, it will abort the import and display an error message.

Click on the Download Error Log button to obtain a file detailing the specific problem records.

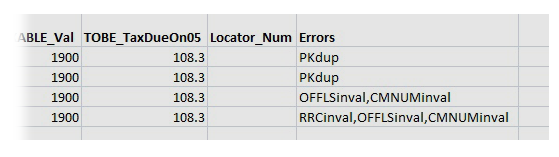

The error log file itself is provided in a comma separated value (CSV) format. The file does not return all imported records; it only contains the problem records. It also does not return all fields for each record, but only the following:

•Mapped Fields

•Numerical Values

•Error Codes

To identify which record from your import file an entry refers, use the Unique Summary Record Identifiers from the error log and your import file.

The error codes for each problem record will be listed in the Errors Column, which is the rightmost column in the file. If there are multiple errors for a record, the error codes will be delimited by commas within the the field

The value for Taxpayer ID is invalid. Taxpayer IDs should be eleven digits only. This is a required field. |

The value for Filing Period is invalid. This is a required field. The value expected is a date in one of the following formats:

•Month/Day/Year (eg. 10/1/2005) •Month Day, Year (eg. October 1, 2005) •YYYY-MM (eg. 2005-10) •YYMM (eg. 0510)

Note: The day value, if included, is ignored for submission purposes. |

The value for Secondary Taxpayer ID is invalid. Taxpayer IDs should be eleven digits only. This is a required field. |

The value for Lease Type is invalid. The value for Lease Type should be either 1 (for oil) or 2 (for gas). |

The value for County Code is invalid. County Code should be a value between 1 and 254. This is a required field. |

The value for Lease Number is invalid. Lease Number should be no more than 6 digits. This is a required field. |

The value for Permit Indicator is invalid. Drilling Permit Indicator should be either 1 (for Yes) or 2 (for No). This is a required field. |

The value for Exemption Type is invalid. This is a required field. See Exemptions Section in the Appendix to see valid values.

|

The value for Taxpayer (Liable for Tax) is invalid. Taxpayer should be either 1 (for Yes) or 2 (for No). This is a required field. |

The value for Off Lease Sale is invalid. Off Lease Sale should be either 1 (for Yes) or 2 (for No). This is a required field. |

The value for Tax Rate is invalid. This is a required field only when the exemption type is 05. The rate should be in decimal format rater than percentage, ie. instead of 3% use 0.03.

Note: If your map has 'Calculate Tax Due on 05' checked, TexRev will attempt to look up and insert the exemption's tax rate automatically. If it can't find the exemption, TexRev considers the exemption type invalid and inserts a value of -1 for the Tax Rate. |

The value for API is invalid. API should eight digits only. This is a required field, but should be listed as 0 is there is no exemption that requires it. |

The value for Tax Reimbursement is invalid. Tax Reimbursement should be either 1 (for Yes) or 2 (for No). This is a required field. |

The value for TaxSubType is invalid. TaxSubType should be either 49 (for a Producer Reported Record) or 37 (for for a Purchaser Reported Record). This is a required field. |

The value for Lease Volume is invalid. Lease Volume should be an integer. This is a required field. |

The value for Your Volume is invalid. Your Volume should be an integer. This is a required field. |

The value for Your Value is invalid. Your Value should be a decimal number. This is a required field. |

The value for Exempt Volume is invalid. Exempt Volume should be an integer. This is a required field. |

The value for Exempt Value is invalid. Exempt Value should be a decimal number. This is a required field. |

The value for Marketing Cost is invalid. Marketing Cost value should be a decimal number. This is a required field. |

The value for Net Taxable Value is invalid. Net Taxable Value should be a decimal number. This is a required field. |

The value for Tax Due on Type 5 is invalid. Tax Due on Type 5 should be a decimal number. This field is only required for Type 5 Exemption records.

Note: If your map has Calculate Tax Due on 05 checked, TexRev will attempt to look up and use the exemption's registered Tax Rate. If it can't find the exemption, TexRev considers the exemption type invalid and uses a value of -1 for the Tax Rate. |

The value for To Be Lease Volume is invalid. To Be Lease Volume should be an integer. This is a required field. |

The value for To Be Your Volume is invalid. To Be Your Volume should be an integer. This is a required field. |

The value for To Be Your Value is invalid. To Be Your Value should be a decimal number. This is a required field. |

The value for To Be Exempt Volume is invalid. To Be Exempt Volume should be an integer. This is a required field. |

The value for To Be Exempt Value is invalid. To Be Exempt Value should be a decimal number. This is a required field. |

The value for To Be Marketing Cost is invalid. To Be Marketing Cost value should be a decimal number. This is a required field. |

The value for To Be Net Taxable Value is invalid. To Be Net Taxable Value should be a decimal number. This is a required field. |

The value for To Be Tax Due on Type 5 is invalid. To Be Tax Due on Type 5 should be a decimal number. This field is only required for Type 5 Exemption records.

Note: If your map has Calculate Tax Due on 05 checked, TexRev will attempt to look up and use the exemption's registered Tax Rate. If it can't find the exemption, TexRev considers the exemption type invalid and uses a value of -1 for the Tax Rate. |

The value for Locator Number is invalid. Taxpayer IDs should be seven digits only. This is a optional field. |

The value for Commodity Number is invalid. This is a required field. Commodity Number should be one of the following numbers or abbreviations:

|

||

Number |

Abbreviation |

Description |

0 |

CP |

Not In Use |

1 |

RG |

Raw Gas |

2 |

IK |

In Kind |

3 |

LU |

Lease Use |

4 |

CN |

Condensate |

5 |

RS |

Residue |

6 |

PR |

Plant Product |

7 |

7? |

Not In Use |

8 |

FE |

Not In Use |

9 |

9? |

Not In Use |

This record has values in its Primary Key Fields that are identical to those of another record in the transaction being imported. In other words, you are trying to submit or amend the same record multiple times.

TexRev will not allow this transaction to be imported as it throws off error correction prediction and normally signifies a duplicate payment on the Taxpayer's part. If both records' values are to be submitted, you should combine them into one record and re-import. |