TexRev automatically checks all submitted records for possible data changes. This category is mandatory and cannot be de-selected. Records that get data changed can throw off reconciling submissions with your financials. With amendments, a data changed record may not update the intended target and could create a new record with an error status. If required, call your account maintenance manager at the State to edit the record for you.

Warnings Returned

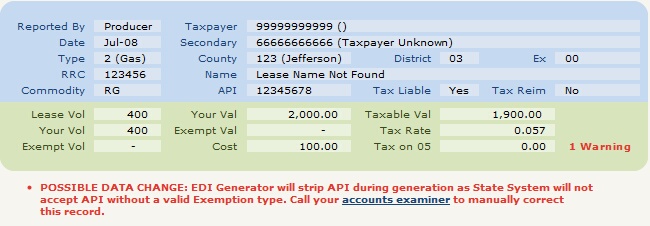

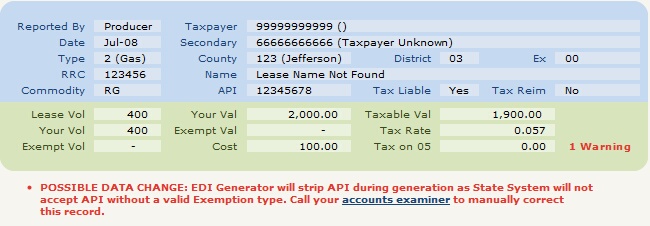

EDI Generator will strip API during generation as State System will not accept API without a valid Exemption type.

Code: API00

Description: This warning occurs when an API number is submitted with a record that is not also reporting an exemption.

The State's EDI maps only allow for API numbers when a Type 03 or Type 07 exemption is being claimed. Since the State would reject your EDI file completely if it finds an API number without an exemption, TexRev strips the field completely from records that are not Type 03 or Type 07.

This can be undesirable as API is a key field for identifying a record to be amended.

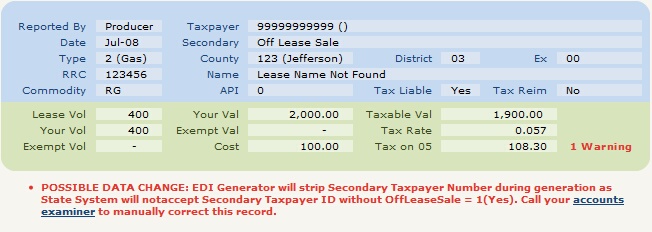

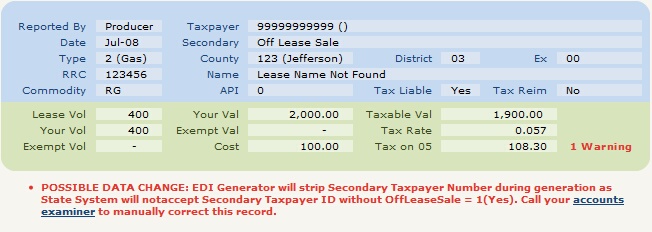

EDI Generator will strip Secondary Taxpayer Number during generation as State System will not accept Secondary Taxpayer ID without OffLeaseSale = 1(Yes).

Code: OFFwSec

Description: This warning occurs when a secondary taxpayer number is submitted with a producer reported record that is also flagged as an off lease sale.

The State's EDI maps only allow for secondary taxpayer numbers when the Off Lease Sale flag is No (2). Since the State would reject your EDI file completely if it finds a secondary taxpayer number with an off lease sale flag, TexRev strips the field completely from the record.

Both Secondary Taxpayer ID and Off Lease Sale are key fields for identifying existing summary records.

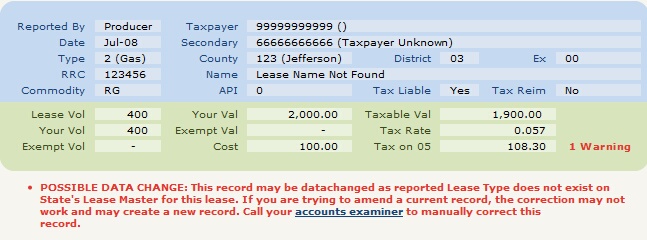

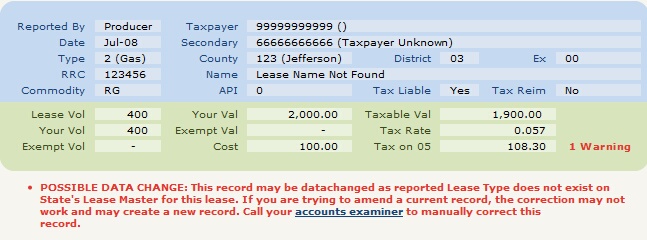

This Record May be Data Changed as Reported Lease Type Does Not Exist on State's Lease Master for this Lease.

Code: LseTypDC

Description: Message returned if TexRev finds the RRC number and county for the submitted lease in the State's Lease Master, but not the lease type.

This record can still be submitted as is, but the lease number may get data changed to the correct lease type by the State's system, and can throw off your financials. Lease Type is a key field for identifying summary records.

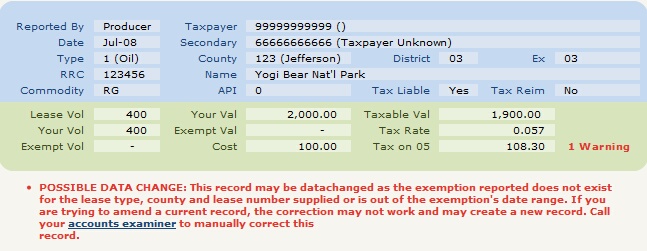

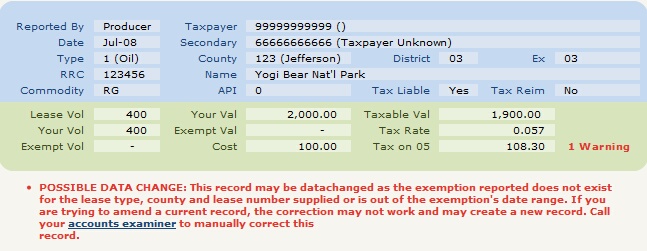

This Record May Be Data Changed as the Exemption Reported Does Not Exist...

Code: ExDC

Description: Message returned if the exemption reported would not be recognized as valid in any way according to the State's rules.

This record can still be submitted as is, but the exemption type may be deleted by the State's system, and can throw off your financials and tax due. Exemption Type is a key field for identifying summary records.

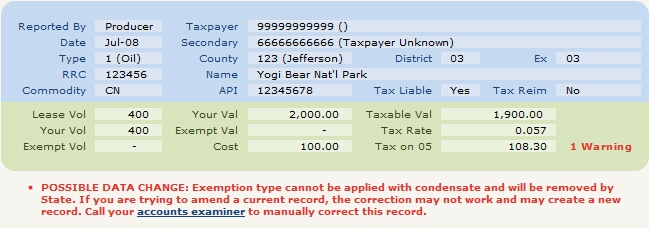

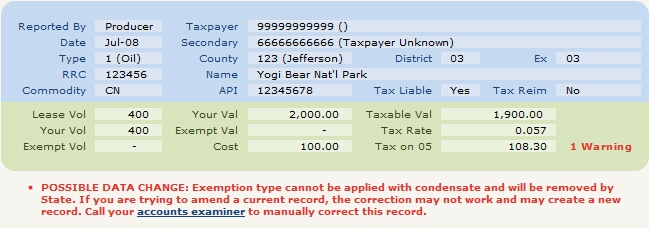

Exemption Type Cannot Be Applied with Condensate and Will Be Removed By State

Code: Ex_CN

Description: Message returned if a record to be uploaded is applying an exemption on a record with commodity type condensate (CN 4).

This record can still be submitted as is, but the exemption type will be deleted by the State's system, and can throw off your financials and tax due. Exemption Type is a key field for identifying summary records.